Summary:

- Bengaluru moved from 21st to 14th position globally in Startup Genome’s 2025 report.

- The ecosystem was powered by $136 billion valuation, aided by four unicorn-scale exits in 2024.

- Seed funding jumped 26%, with 114 deals reflecting early-stage energy.

- AI & Big Data helped Bengaluru rank 5ᵗʰ globally in tech sub-sector performance.

- Rising infrastructure stress, housing costs, and urban strain challenge the city’s long-term trajectory.

There’s a rhythm to Bengaluru that feels uniquely its own—morning filter coffee aromas mixing with the buzz of pitch meetings, dusty autorickshaws humming past billboards for the latest tech IPO, and bootstrapped founders coding in co-working spaces long past midnight. In 2025, that rhythm crescendoed.

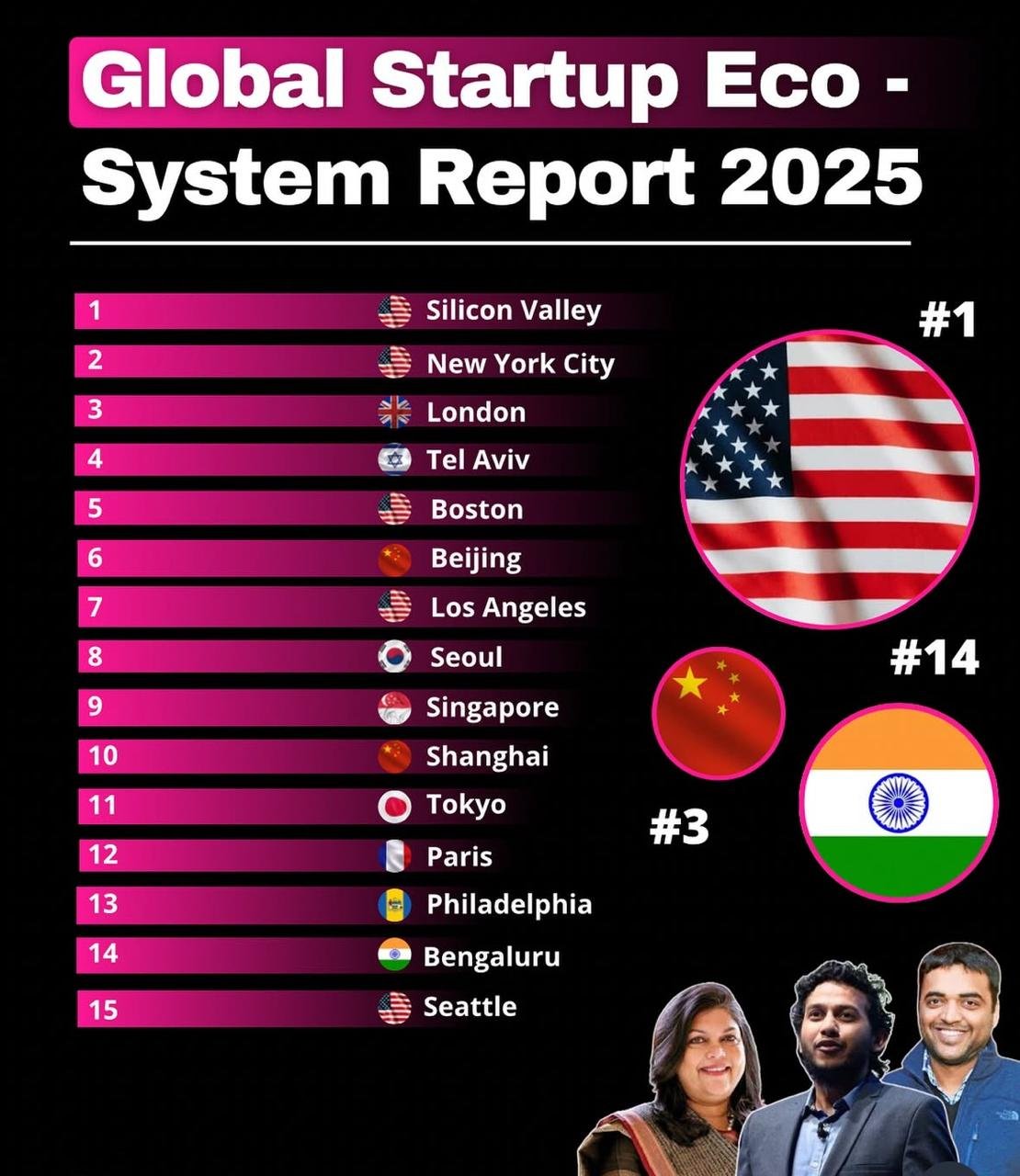

Bengaluru, often described as India’s Silicon Valley, jumped seven spots to 14ᵗʰ in the Global Startup Ecosystem Report 2025, released by Startup Genome. Once considered a scrappy underdog among global tech cities, it’s now inching into elite company—alongside Tel Aviv, Berlin, and Singapore.

But this wasn’t an overnight miracle. It was a story years in the making.

A Year of Breakthroughs: Billion-Dollar Exits and a New Narrative

In 2024 alone, four Bengaluru-based startups burst through the billion-dollar mark:

-

Swiggy led the charge with a blockbuster $12 billion IPO.

-

GoDigit, Indegene, and BlackBuck followed, bringing scale and spotlight.

These exits were more than capital events—they were cultural shifts. They rewrote how global investors saw India’s ability to produce high-growth, globally relevant startups. The ecosystem’s valuation soared to $136 billion, a figure once reserved for countries, not cities.

For local founders like Neha Kapoor, who runs a sustainable packaging startup incubated at IIM-Bangalore, Swiggy’s IPO was more than financial news.

“It gave us belief,” she said. “That if they could do it, we could too. Suddenly, we weren’t just building for India—we were building from India, for the world.”

Seed Surge: Why the Pipeline is Stronger Than Ever

Behind every unicorn is a sea of early bets, and Bengaluru’s seed stage funding is on fire.

According to the report, seed investments rose 26% year-on-year, reaching $268 million across 114 deals. These numbers suggest something deeper: founders are starting earlier, failing faster, and pivoting better. Bengaluru is no longer waiting for validation—it’s building its own future.

This momentum is being enabled by a vibrant support web—angel investors, mentors, tech universities, and a mushrooming number of incubators and accelerators. Even second-time founders who once exited their startups are coming back as VCs or ecosystem builders.

“It’s becoming cyclical,” noted Raghav Menon, a Bengaluru-based investor. “A founder’s success turns into someone else’s seed round.”

AI, Data, and the New Vanguard of Innovation

What truly sets Bengaluru apart now is its deep tech evolution.

In AI and Big Data, Bengaluru ranked 5ᵗʰ globally—ahead of heavyweight cities like Tokyo and Toronto. Research institutions, combined with India’s top engineering colleges and new government-backed AI Centers of Excellence, have created an environment where algorithms are being built for everything—from optimizing farm yields to predicting cancer outcomes.

Startups like Aindra Systems (AI for healthcare diagnostics) and Locus (AI-based logistics optimization) are already making global waves. These aren’t just businesses; they’re lifelines to sectors long underserved.

“AI in India isn’t just about chatbots and voice assistants,” said Apoorva Mishra, a data scientist. “It’s about rural banking, flood prediction, and saving lives.”

But Growth Has a Cost: Cracks in the Concrete

For all the unicorn buzz and term sheet sprints, Bengaluru’s rise is also exposing its fragility.

Residents face chronic traffic jams, rising housing prices, and strained water infrastructure. The very growth fueling the tech ecosystem is eroding the city’s livability.

“We’re scaling startups but struggling to scale the city,” said urban planner Meera Krishnamurthy. “Without long-term urban planning, our innovation could outpace our ability to host it.”

This tension isn’t unique—Silicon Valley, New York, and London have all faced it. The question is: can Bengaluru learn from them without losing its soul?

Case Study: Swiggy—More Than a Meal Delivery IPO

Swiggy’s IPO wasn’t just about money. It was about maturation.

Founded in 2014, Swiggy battled regulatory hurdles, razor-thin margins, and fierce rivals. Its $12 billion IPO in 2024 marked not just success, but resilience—the kind that startups across the country now draw inspiration from.

Today, Swiggy employs over 5,000 people directly and supports over 300,000 delivery partners. Its data science team is one of the most respected in Asia. But more importantly, it catalyzed a belief in Bangalore’s ability to scale local ideas into global phenomena.

For first-time founder Yash Raj, who is working on a last-mile delivery AI startup, Swiggy is a blueprint.

“They didn’t just build a business,” he said. “They built a roadmap for the rest of us.”